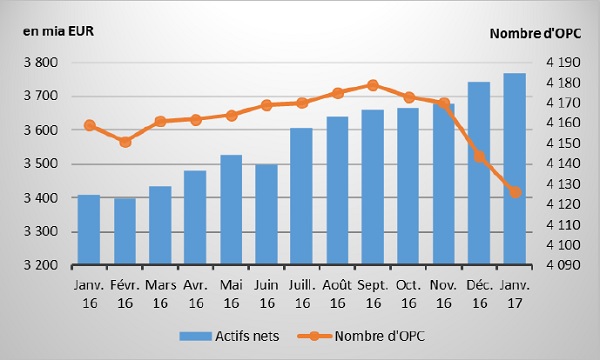

The Commission de Surveillance du Secteur Financier (CSSF), Luxembourg's financial regulator, has announced that the total net assets of collective investment undertakings, including UCIs subject to the 2010 Law, specialised investment funds and SICARs, stood at €3,767.387 billion on 31 January 2017, compared to €3,741.330 billion on 31 December 2016, an increase of 0.70% over one month; over the last twelve months, the volume of net assets is up by 10.53%.

In January, the Luxembourg UCI industry recorded a positive change of €26,057 billion. This increase represents the net positive issuance of up to €23,707 billion (0.64%) and favourable market developments of €2,350 billion (0.06%).

Meanwhile, the number of undertakings for collective investment (UCIs) taken into consideration is 4,126 compared to 4,144 the previous month. A total of 2,645 entities have adopted a multiple compartment structure representing 13,113 compartments. By adding 1,481 entities with a traditional structure, a total of 14,594 units are active in the financial centre.